House depreciation formula

What is the depreciation rate for real estate. Calculate the Depreciation Amount to be Considered.

10 Cash Flow Boosting Facts About Property Depreciation Diy Property Investment Calculator App App Investing

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

. How to Calculate Straight Line Depreciation. Calculate the business use percentage of your home. According to the IRS the depreciation rate is 3636 each year.

2 Methods of Depreciation and How to Calculate Depreciation. Count the number of rooms in your home. Select Popular Legal Forms Packages of Any Category.

This depreciation calculator is for calculating the depreciation schedule of an asset. However if you only use a portion of the. The depreciated value of the property is 1060 ie.

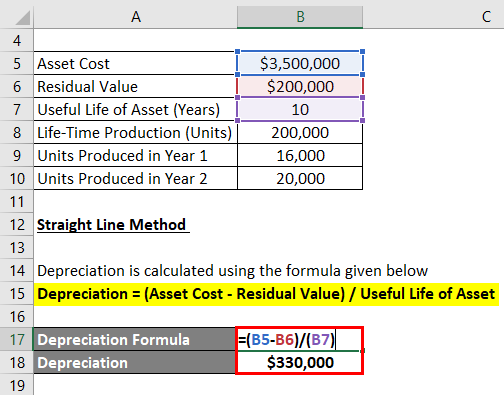

This is the remaining. Number of years after construction Total useful age of the building 2060 13. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along.

Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the. It provides a couple different methods of depreciation. 21 Fixed Installment or Equal Installment or Original Cost or Straight line Method.

Home Appreciation Formula. If the house is only used as a rental property the business use percentage is 100 percent. You can claim 20 of your homes expenses if your office takes up 20 of your homes total space.

F P 1 i ⁿ. In such cases depreciation is arrived at through the following formula. At this point you might be wondering if you still have an advanced calculator lying.

F 250000 1 004 5. Subtract the estimated salvage value of the asset from. We need to define the cost salvage and.

22 Diminishing balance or Written down. Determine the cost of the asset. First one can choose the straight line method of.

The straight line calculation steps are. Your home policy has a 2000 deductible. Estimate the useful life of the fixed assets and calculate the depreciation amount to be reduced from the asset value each year.

The recovery period varies as per the method of computing depreciation. All Major Categories Covered. Recoverable depreciation is a feature that is sometimes not worth it when you factor in the deductible.

Depreciation What Is The Depreciation Expense

Depreciation Of Property Definition Tips To Calculate A Complete Guide Real Estate Photography Real Estate Buying Real Estate

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation What Is The Depreciation Expense

Straight Line Depreciation Calculator And Definition Retipster

What Is A Property Depreciation Calculator It Helps You To Estimate The Likely Tax Depreciation Benefit Investing Investment Property Loan Repayment Schedule

Depreciation Formula Examples With Excel Template

Download The Depreciation Calculator For Excel From Vertex42 Com Calculator Excel Calculators

How To Use Rental Property Depreciation To Your Advantage

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Is A Cost Segregation Study Worth It Investing Study Being A Landlord

Appreciation And Depreciation Calculator Https Salecalc Com Appdep Appreciation Calculator Calculators